Central Bank Digital Currencies

Central bank digital currencies (CBDCs) may not be essential to achieving intended policy goals, instead addressing underlying constraints and improving other digital payment systems may be a more practical alternative, a survey of 19 central banks in the Middle East and Central Asia (ME&CA) region by the International Monetary Fund’s (IMF) has said.

Israel’s central bank is launching a challenge on the use of a central bank digital currency in payments as part of an “action plan for a possible issuance of the digital shekel.”

Former President Donald Trump joins Ron DeSantis as a critic of CBDCs.

(Jason Leung/Unsplash, modified by CoinDesk)

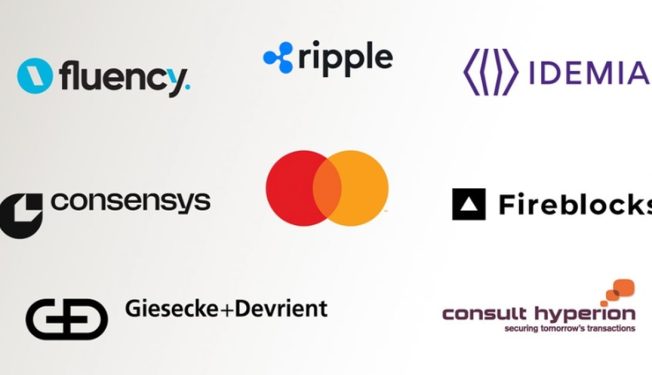

Payments giant Mastercard has created a forum where crypto industry players can discuss and collaborate on central bank digital currencies, injecting its influential voice into the CBDC conversation as nations around the world consider whether to digitize their money.

DeSantis in March signed a bill as Florida’s governor to prohibit the use of CBDC’s within his state.

The recent collapse of three high-profile banks – Silicon Valley Bank, Silvergate Bank and Signature Bank – has caused worrying outflows at hundreds of regional banks. Now, with the U.S. Federal Reserve creating a new backstop facility reportedly worth $2 trillion and Switzerland’s central bank bailing out Credit Suisse to the tune of $54 billion, the echoes of prior crisis in 2008 and 2013 are loud.