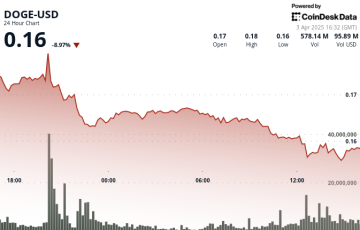

The price tumbles back down to its natural market position. Here’s a simple way to get started with technical analysis. To avoid these schemes, consider trading volume when you select coins or tokens to trade. When you’re trading cryptocurrency for profit, it’s important to keep a level head and evaluate opportunities thoroughly. And avoid the temptation of the fear of missing out. You can look for market correlations by comparing price charts for different coins. FOMO can lead you into a lot of bad decisions if you’re not careful.

The price tumbles back down to its natural market position. Here’s a simple way to get started with technical analysis. To avoid these schemes, consider trading volume when you select coins or tokens to trade. When you’re trading cryptocurrency for profit, it’s important to keep a level head and evaluate opportunities thoroughly. And avoid the temptation of the fear of missing out. You can look for market correlations by comparing price charts for different coins. FOMO can lead you into a lot of bad decisions if you’re not careful.

For the purposes of this discussion, a trader is not an investor. The goal is to get in and get out fast, pocketing the profits. 1. Fundamental analysis is based on the fundamentals of a company or project, including its product vision, its existing customer base, the quality of the team, partnerships, current revenue, and so on. Some turn a profit. Investors set goals. Build portfolios for long-term return. That’s what day trading crypto is all about. The trader is focused on profits right now. Most traders lose money.

For the purposes of this discussion, a trader is not an investor. The goal is to get in and get out fast, pocketing the profits. 1. Fundamental analysis is based on the fundamentals of a company or project, including its product vision, its existing customer base, the quality of the team, partnerships, current revenue, and so on. Some turn a profit. Investors set goals. Build portfolios for long-term return. That’s what day trading crypto is all about. The trader is focused on profits right now. Most traders lose money.

Crypto Trading-bot Github

This fractal dynamic allows the discerning trader to spot cycles at different time frames (hourly, daily, weekly, monthly) and then take advantage at the right moment by timing entry and exit positions accordingly. The danger is getting drawn into the day-to-day, hour-to-hour, even minute-to-minute volatility of the markets, leading newbie traders to over-trade based on the heat of the moment. The best way to trade crypto is to do lots of study and preparation. Learning technical and fundamental analysis certainly takes some time. But it’s not the most difficult part of trading.

Eight Most Well Guarded Secrets About Trading Crypto

Financial trading is a fantasy career for people around the world. It’s more accessible and more exciting than trading stock, gold, or soybean futures. Many of us dream of outsmarting the market. This guide will help you navigate the exciting yet risky world of trading cryptocurrency. Just create an account at Kriptomat or another exchange and begin trading. Crypto lets anyone become a trader. Our goal is to give you a sensible perspective about crypto trading that most traders learn only after months or years of trial and error. There’s no need to register with a brokerage, pay expensive fees, qualify for trader status, or any of that with crypto trading.

This type of analysis may help you decide whether to keep more of your portfolio in BTC or branch out into coins that usually gain or lose value compared to Bitcoin. Good luck! This text is informative in nature. Should not be considered an investment recommendation. Having a diversified portfolio is a sensible way to minimize losses and take advantage of market gains. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose. Your next step, of course, is to establish an account at the best crypto trading platform.

This type of analysis may help you decide whether to keep more of your portfolio in BTC or branch out into coins that usually gain or lose value compared to Bitcoin. Good luck! This text is informative in nature. Should not be considered an investment recommendation. Having a diversified portfolio is a sensible way to minimize losses and take advantage of market gains. It does not express the personal opinion of the author or service. Any investment or trading is risky, and past returns are not a guarantee of future returns. Risk only assets that you are willing to lose. Your next step, of course, is to establish an account at the best crypto trading platform.